At LaSalle for MO7, we understand the importance of staying informed about local tax policies. Jackson County Missouri property taxes have been a hot topic recently, with significant changes and controversies affecting many residents.

In this post, we’ll break down the essentials of property taxes in Jackson County, explore recent developments, and provide guidance on the appeal process.

What Are Jackson County Property Taxes?

The Basics of Property Taxation

Property taxes in Jackson County, Missouri serve as a primary source of revenue for local government services. These taxes fund essential community needs such as schools, roads, and public safety. As residents of Jackson County, we all feel the impact of these taxes, making it essential to understand their mechanics.

Calculation Method

Jackson County calculates property taxes based on the assessed value of your property. The county assessor determines this value, which represents a percentage of the property’s market value. For residential properties, the assessed value is calculated based on the market value. Commercial properties are assessed differently.

The tax rate (also known as the levy) applies to this assessed value. To understand how much you might pay in property taxes, you can use a property tax calculator specific to Jackson County, Missouri.

Types of Taxable Properties

Property taxes in Jackson County apply to both real and personal property:

- Real Property: This category includes land and buildings.

- Personal Property: This encompasses items such as vehicles, boats, and business equipment.

(It’s worth noting that even if you no longer own a vehicle assessed on January 1st, you remain responsible for the full tax amount due on December 31st.)

Recent Assessment Changes

Jackson County has experienced significant shifts in property assessments in recent years. These changes have sparked public outcry and legal challenges.

In fact, according to a recent report, the Missouri State Auditor claimed that Jackson County broke the law by improperly raising home valuations. This controversy has led to heated debates and discussions about the fairness and legality of the assessment process.

These changes have significant implications for homeowners and the community at large. As Jackson County residents, we must stay informed about these changes and understand their impact on our community.

The controversy surrounding these recent assessment changes has led to heated debates and discussions. Many homeowners express concern about the sudden increase in their tax burden, while local officials defend the reassessments as necessary to reflect true market values. This tension sets the stage for our next topic: the recent changes and controversies in Jackson County property taxes.

Property Tax Turmoil in Jackson County

The Reassessment Shock

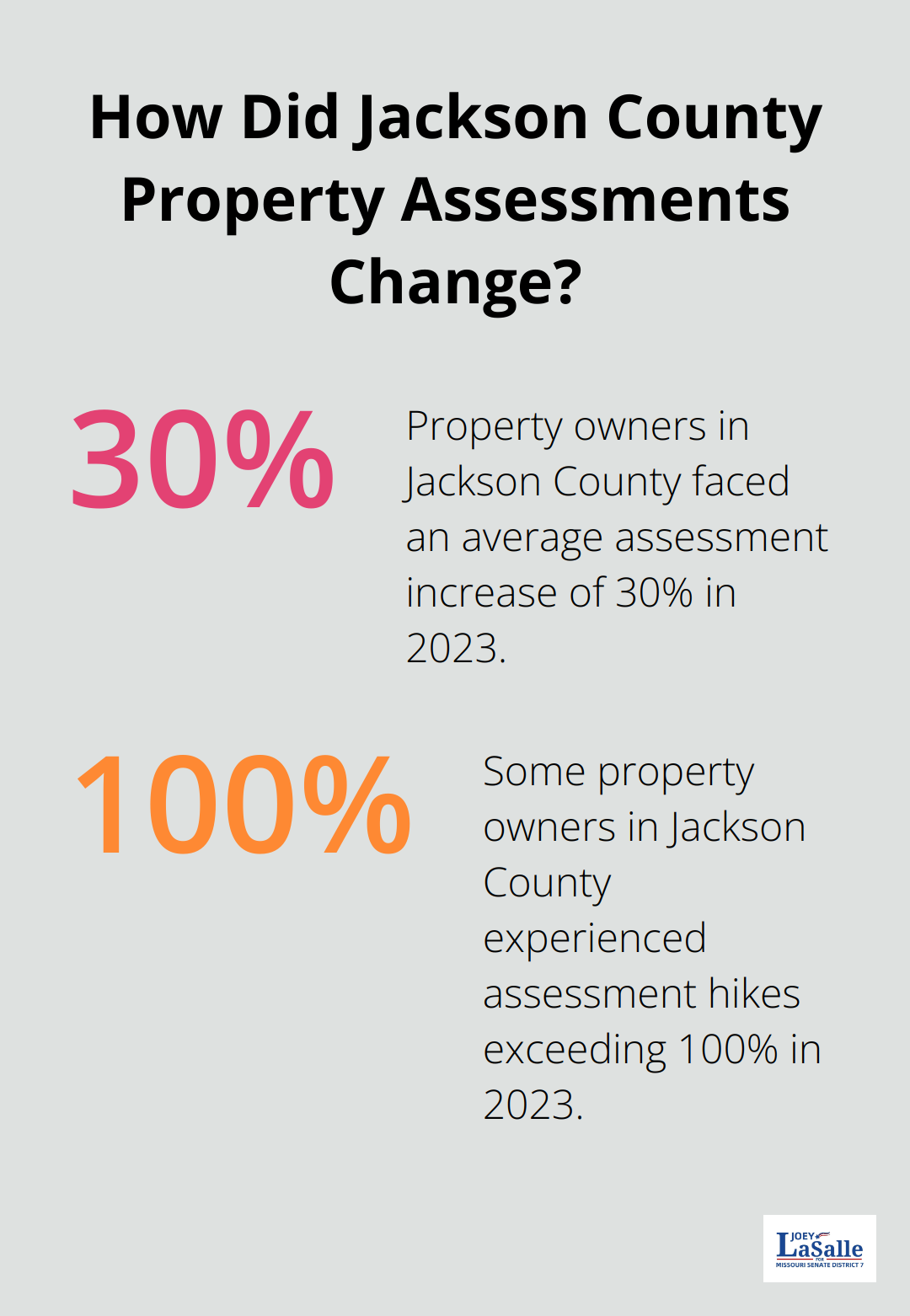

Jackson County’s recent property reassessments have ignited a firestorm of controversy and legal challenges. In 2023, property owners faced an average assessment increase of 30%, with some experiencing hikes exceeding 100%. This dramatic surge left many residents questioning the fairness of the process.

The Jackson County assessment department claims these increases are necessary to align over 301,000 properties with market value after years of undervaluation. However, the abrupt nature of these changes caught many homeowners off guard.

Public Outcry and Concerns

The public reaction has been swift and vocal. Homeowners across Jackson County express deep concerns about their ability to afford these unexpected increases, especially those on fixed incomes. Local community groups have organized protests and town hall meetings to voice their frustrations. The Jackson County Board of Equalization received an overwhelming number of appeals, forcing them to extend the deadline to July 31, 2023.

Legal Battles and Political Fallout

The controversy has escalated to the legal arena. Missouri Attorney General Andrew Bailey launched an investigation into the legality of these assessments. A lawsuit against Jackson County is set for trial on June 6, 2024, focusing on alleged illegal property tax assessment practices. The suit claims that Jackson County officials failed to provide timely notice of property assessments and did not conduct required physical inspections of properties, violating Missouri law.

In response to the public outcry, some local politicians have called for a cap on assessment increases or a freeze on property taxes for those 62 or greater in age. However, these proposals face significant hurdles due to state laws governing property assessments.

Impact on Residents

The sudden increase in property taxes has far-reaching consequences for Jackson County residents. Many homeowners now struggle to budget for these unexpected expenses, potentially forcing difficult decisions about their living situations.

As the legal battles unfold and political debates continue, Jackson County residents must stay informed about these developments. The outcome of these challenges will shape the future of property taxation in the county for years to come. In the next section, we’ll explore the steps property owners can take to appeal their assessments and potentially mitigate the impact of these increases.

How to Appeal Your Jackson County Property Tax Assessment

Understanding the Appeal Process

Jackson County property owners who face steep increases in their tax assessments can challenge their new property values. The appeal process involves filing a formal appeal with the Jackson County Board of Equalization, an independent body that reviews assessment disputes and has the authority to adjust property values.

To initiate an appeal, property owners must complete the official appeal form available on the Jackson County website. It’s essential to fill out all sections accurately (incomplete forms may delay the process). The form requires contact information, property details, and the reason for the appeal.

Gathering Compelling Evidence

The success of an appeal depends on the strength of the evidence presented. Property owners should collect documentation that supports their claim of overvaluation. This might include:

- Recent appraisals of the property

- Sales data for comparable properties in the neighborhood

- Photos showing condition issues that might affect the home’s value

- Property inspection reports highlighting structural problems

(The goal is to prove that the assessed value doesn’t accurately reflect the property’s true market value.)

Timing and Deadlines

Jackson County typically allows property owners until the third Monday in June to file an appeal. However, due to high volumes of appeals in recent years, this deadline has sometimes been extended. Property owners should check the Jackson County Board of Equalization website or contact their office directly for the most up-to-date information on deadlines.

It’s critical to submit the appeal and all supporting documentation before the deadline. (Late submissions are generally not accepted, so property owners shouldn’t wait until the last minute to start gathering evidence.)

Potential Outcomes

If an appeal succeeds, the property owner could see a reduction in their property’s assessed value, leading to lower property taxes. Even if the appeal is denied, the property owner will have gained valuable insight into the assessment process, which could prove useful in future years.

Seeking Professional Assistance

For complex cases or high-value properties, property owners might consider seeking professional help. Real estate attorneys or property tax consultants can provide expertise in navigating the appeal process and presenting a strong case. While this involves additional costs, it could potentially lead to significant tax savings in the long run.

Final Thoughts

Jackson County, Missouri property taxes have sparked significant debate and legal challenges. These changes affect residents across the county, highlighting the importance of understanding local tax policies. Property owners must stay vigilant and proactive in comprehending their rights and responsibilities regarding taxation.

The recent controversies surrounding property assessments underscore the need for transparency and fairness in the taxation process. Numerous resources are available for those seeking further information or assistance with Jackson County, Missouri property taxes. The Jackson County Assessment Department website provides valuable information on property valuations and tax rates (while local community organizations and legal aid services can offer guidance on navigating the appeal process).

At LaSalle for MO7, we address these critical issues and work towards innovative fiscal policy reforms to reduce tax burdens. We believe in creating a more prosperous and equitable community for all residents of Missouri’s 7th Senate District. To learn more about our efforts to combat rising property taxes and other key initiatives, visit our campaign website or follow us at Facebook.

Missouri’s Republican Supermajority and Joey LaSalle’s Role

Missouri’s Republican supermajority plays a key role in shaping legislative decisions and directing resources. Joey LaSalle has the skills and experience to work effectively within this political environment to advocate for District 7. His ability to navigate the supermajority is essential for addressing community concerns and driving meaningful change. To learn more about how the supermajority impacts state policies, explore the Missouri Senate District Map 2024 and details on Missouri State Senators 2024.

Call to Action:

Joey LaSalle takes a proactive approach to solving problems in District 7. He is committed to reducing crime, boosting the economy, creating jobs, and improving community resources like education, health services, and infrastructure. Kansas City has faced years of misrepresentation in Jefferson City. Now is the time for effective leadership that truly understands our community’s needs. Joey aims to lower taxes and ensure affordable housing, making him the only Republican candidate capable of genuinely representing Kansas City and Grandview in Missouri’s supermajority. Unlike typical politicians, Joey focuses on solving real problems and putting people first.

For more details on Joey’s plans for Missouri’s 7th District, visit joe4mo7.com. To see how he compares to other candidates, check out this article at Missouri Senate District 7 | KC Voter Guide 2024. You can also find additional insights about his campaign and political stance on Ballotpedia and his profile on Lyke. Joey proudly supports Tracey Chappell for prosecutor in Jackson County, the only candidate with the right experience to tackle the county’s challenges.

Additionally, we support Republican Derron Black’s initiatives in District 9. Like Joey, Derron is committed to authentic leadership that puts the community ahead of political ambitions.

For a stronger future in Kansas City and Grandview, vote for Joey LaSalle, the candidate who delivers real change. Stay connected with Joey on Facebook and Twitter and learn more about his priorities at joe4mo7.com. Together, we can bring the leadership Kansas City deserves to Jefferson City.